SINGLE CANDLESTICK PATTERNS

These are some of the simplest patterns you can find, comprising just one trading period. Often, they form the building blocks of longer patterns.

Spinning Tops

A spinning top is formed when a candlestick has a long wick both above and below a narrow body. So the market had an extensive trading range, but little difference between its open and close. Unlike most candle patterns, it doesn’t really matter if a spinning top is formed on a red or green stick – there just needs to be a small body and a long wick.

In a spinning top, there’s a tug of war between buyers and sellers. But the bears and bulls are cancelling each other out, so there’s little in the way of actual movement.

Technical traders take spinning tops as an indication of weakness in an ongoing trend. If a market forms a spinning top after a lengthy bull run, then positive sentiment may be running out. After a downtrend, meanwhile, bullish opinion may be gaining strength.

DOUBLE CANDLESTICK PATTERNS

When a signal is formed from two consecutive periods, it’s known as a double candlestick pattern. This is not as strong as an indicator with 3 candle stick combinations hence these often become a hint at upcoming trend reversals, but can also be used to identify continuations

ENGULFING

In the engulfing pattern, a candlestick is immediately followed by another larger one in the opposite direction.

> Bullish engulfing pattern

> Bearish engulfing pattern

> In the bullish engulfing, a red candle is dwarfed by the green one that follows it.

> Technical traders might take this as a sign that positive opinion is taking hold, so a significant move up may be on the way – particularly if a bullish engulfing appears after a period of consolidation.

> A bearish engulfing arises when a bullish stick is then swallowed by a subsequent bearish one. So negative opinion may be forming.

TRIPPLE CANDLESTICK PATTERNS

The longest patterns we’ll cover in this section are triples, which are made across 3 consecutive periods. Triple candlestick patterns are often seen as some of the strongest signals of an upcoming move, especially in context with

other chart elements.

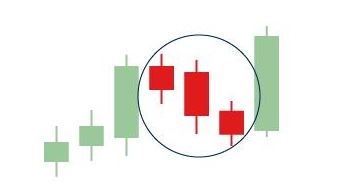

Morning Star

A morning star plays out as a market hits a point of indecision after an extended downward movement, then begins to recover. It consist of 3 candlesticks:

> A red on with a large body which is part of the downtrend

> A candle with a short body, often a spinning top, indicating that bulls are entering into the session

> A green stick with a tall body confirming that a reversal has began

Traders may take this as a sign that the recovery with turn into a lasting uptrend